Underwriting Disability Insurance with Mental Nervous Disorders

When considering disability insurance, most people think of coverage for physical injuries or illnesses that prevent them from working. However, mental and nervous disorders (MNDs) also play a significant role in an individual’s ability to maintain employment. The Social Security Administration reports that 35% of all disability insurance beneficiaries are due to MNDs. With the increasing awareness of mental health, the importance of understanding how disability insurance covers MNDs cannot be overstated.

The Importance of Disability Insurance for Mental Health

Disability insurance provides financial support if your client becomes unable to work due to illness or injury. Mental nervous disorders, which include conditions like depression, anxiety, bipolar disorder and post-traumatic stress disorder (PTSD), can be just as debilitating as physical conditions. These disorders can significantly affect a person’s cognitive function, emotional stability and overall ability to perform work tasks.

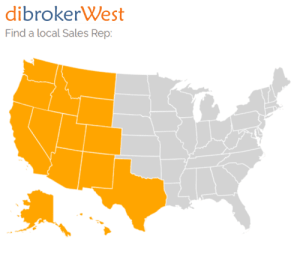

At dibrokerWest, we work with advisors across the country to help secure disability insurance coverage for clients with complex medical histories. One area that consistently requires careful guidance is underwriting for mental or nervous (M/N) disorders.

Mental health conditions can trigger limitations or exclusions—often surprising clients who’ve been stable and high-functioning for years. As your disability insurance partner, we’re here to demystify the process and help you navigate it with confidence.

Challenges in Underwriting Mental Nervous Disorders for Disability Insurance

When it comes to underwriting disability insurance, mental nervous disorders present unique challenges. Insurance companies assess risk to figure out the likelihood of a claim being made. Due to the subjective nature of mental health conditions and their varying degrees of severity, insurers often approach MNDs with caution.

What Underwriters Look For

When reviewing a disability insurance application with a mental nervous history, carriers often request:

- Medical Records from primary care and behavioral health providers

- Prescription History showing medication types, dosages, and stability

- Therapy Notes or summaries of counseling sessions (if applicable)

- Hospitalization Records, especially for inpatient treatment or crisis intervention

- Employment and Functional History, including any prior disability leave or performance issues

Our team helps you gather and present this information in a way that supports the strongest possible offer.

Common Underwriting Results

Here’s what your clients might see depending on their mental health history:

✅ Standard Offer (Least Common)

Reserved for mild, well-controlled conditions (e.g., situational depression or short-term anxiety with no recent symptoms or treatment).

⚠️ Mental Nervous Limitation Rider (Most Common)

Limits disability benefits for mental/nervous claims to 24 months—even if the policy benefit period is longer. Most carriers will apply this rider automatically if there’s any notable history of psychiatric care.

📉 Modified Offers

Examples include shorter benefit periods, benefit amount reductions, higher premiums, or exclusions of specific diagnoses.

❌ Decline

In cases involving recent hospitalizations, suicide attempts, or severe ongoing conditions (e.g., unmanaged bipolar disorder), carriers may decline to offer coverage.

- Pre-existing Conditions: If your client has a history of mental nervous disorders, insurers might consider this a pre-existing condition, which could affect the policy’s terms. Some insurers may impose a waiting period, exclude coverage for MNDs or charge higher premiums..

- Policy Limitations and Exclusions: Disability insurance policies often have specific limitations or exclusions related to MNDs. Some policies may cover mental nervous disorders for a limited period, such as two years, while others may exclude them altogether. It’s essential that your clients review their policy carefully to understand what is and isn’t covered.

- The Stigma Factor: Unfortunately, despite growing awareness, there is still a stigma associated with mental health, which can influence how insurers view these conditions. This stigma can sometimes lead to stricter underwriting guidelines for applicants with a history of MNDs.

Tips for Securing Disability Insurance Coverage with Mental Nervous Disorders

At dibrokerWest, our job is to help you get ahead of these roadblocks and deliver the best possible outcome for your clients. Here’s how:

- Work with a Specialist: An insurance broker or agent specializing in disability insurance can be invaluable. They can help you navigate the complexities of underwriting and find a policy that offers adequate coverage for MNDs. dibrokerWest has been a top disability insurance brokerage for more than 20-years so you’re in the right place!

- Pre-Screening Expertise

We review your client’s history confidentially and match them with the most appropriate carrier before you even submit an app. - Medical Summary Guidance

Need help explaining the condition? We’ll walk you through how to craft a narrative that highlights stability and treatment success. - Carrier Strategy

Not all carriers treat mental nervous disorders the same. We know which ones to lean into and which to avoid depending on your client’s profile. - Appeal and Negotiate: If you’re initially offered a policy with exclusions or higher premiums due to a history of MNDs, don’t be afraid to appeal the decision or negotiate. Providing more medical documentation or working with your healthcare provider to present a comprehensive picture of your mental health can sometimes lead to more favorable outcomes.

Conclusion

Underwriting disability insurance with mental nervous disorders can be complex, but it’s not impossible. At dibrokerWest, we’re committed to helping you serve every client with empathy, transparency, and smart underwriting strategy.

Have a client with a mental nervous history? Let’s talk. We’ll guide you through the process and help protect the income they’ve worked so hard to earn.

Need help navigating a tough case?

Submit a quote request through our Advisor Portal Quote Request Wizard or reach out to your local Regional Sales Reps for details!