The Perfect Storm: Why Disability Income Protection Is More Critical Than Ever

Life has a way of throwing curveballs when we least expect them. While most clients focus on growing their savings or investing for retirement, they often overlook a critical piece of the financial planning puzzle: protecting their income. That’s where disability insurance and income protection insurance come in—and they could save your clients from financial disaster.

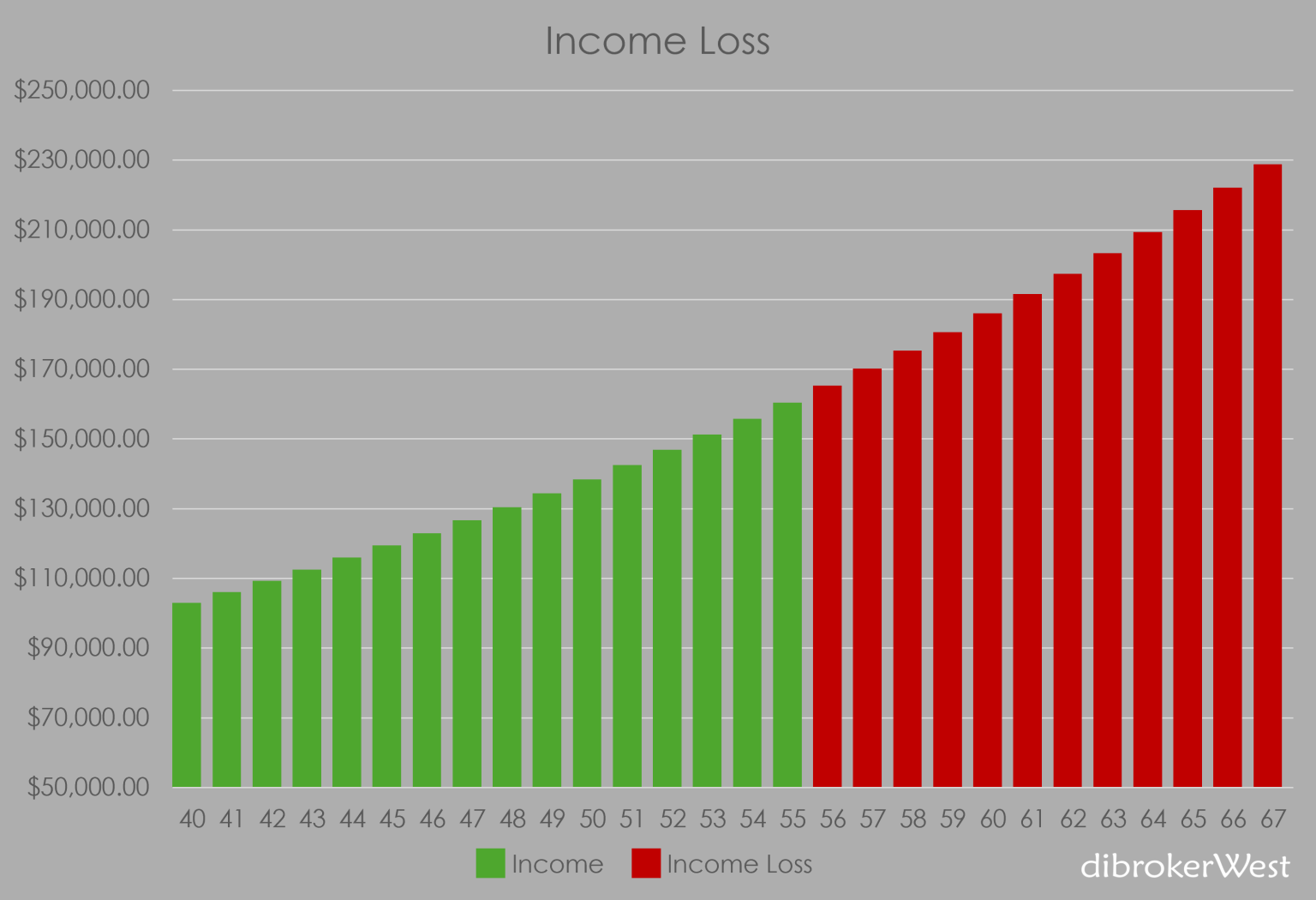

What a Realistic Income Loss Could Look Like

No one expects to face a serious illness or injury, but health-related income loss can happen to anyone. Statistically, it may not strike this year or even in the next five—but what happens if it does during your clients’ peak earning years?

Picture this: your client is 56 years old, earning over $100,000 a year with 3% annual raises. A sudden health issue forces your client to stop working. Your client is unable to return to your job before the age of 67. The result? A staggering $2.2 million in lost income.

The chart above illustrates your clients’ projected annual income from age 40 to 67, assuming a base income of $100,000 at age 40 with 3% annual increases. The income is shown in green from age 40 to 55. The income loss, shown in red from 56 to 67, represents a total Income Loss is $2,277,398.

Key Insights

-

Green Bars (Income): Represent actual earned income from age 40 to 55.

-

Red Bars (Income Loss): Represent the potential income that was not earned from age 56 to 67.

-

The total Income Loss is $2,277,398, indicating the cumulative amount of income missed during that period (assuming early retirement or loss of employment at 55).

This kind of scenario is what disability income insurance is designed to protect against!

Why Timing Matters in Income Protection Planning

As your client gets older, their risk of experiencing a health event increases. Ironically, this is also when your clients’ income is typically at its highest. Without an income protection plan, a long-term disability could derail your clients’ retirement savings, putting their family’s financial security at risk and resulting in long-term debt.

Even a short-term disability can lead to significant income gaps, especially if your client is self-employed or has limited sick leave.

The Real Mistake: Underestimating the Financial Risk

The most common mistake people make is underestimating the financial impact of a disability. Many assume they’ll rely on savings or short-term workarounds—but the numbers paint a different picture. Most households can’t sustain their lifestyle without a paycheck for more than a few months.

Without long-term disability insurance or some form of income replacement coverage, a single health event can wipe out years of progress toward your clients’ financial goals.

What Your Client Can Do Now: Take a Proactive Approach

If your client doesn’t already have a plan in place, the best time to act is now. A simple income protection analysis with a financial advisor or insurance agent can show:

- How much income your client stands to lose in the event of a disability

- What type of disability insurance coverage fits your clients’ career and lifestyle

- How to choose between short-term and long-term disability insurance

Your client insures his car, his home and even his smartphone so why not insure the very thing that pays for all of it? Your income is your most valuable asset.

Don’t wait for the perfect storm to strike. Prepare today with a personalized income protection strategy—and protect your financial future.