Accounting for Disability Insurance Coverage

Statement No. 112 of the Financial Accounting Standards Board, popularly referred to as FASB 112, is a critical post-employment standard for employers to be aware of. FASB 112 requires employers to hold any post-employment benefits as a liability on their balance sheet. And not just the current benefit being paid, but the ESTIMATED TOTAL of that liability..

Disability = Post-employment benefit.

Self-Funding Disability Benefits is Costly

For employers, self-funding disability benefits to highly compensated executives can require a MASSIVE balance sheet dispute.

Example:

- 55 year old CEO

- Earns $700,000

If the CEO faces an illness (or serious injury) and can’t work, the company will likely continue the CEO’s income during recovery. A portion of these benefits can likely be covered by the employer’s Group LTD policy, let’s say $10,000/month or $120,000/year. Since this isn’t nearly enough, the company will elect to supplement the CEO’s benefit payments to pre-disability earnings ($700k).

FASB 112 requires the company to hold a liability for estimated future benefit payments. In this case, $700,000 – $120,000 = $580,000.

Here’s the kicker, “estimated payments” isn’t just for one year. It’s likely 5-10 years, or sometimes even to age 65 when accounting for a disability. That’s $580,000 x 10 years = $5,800,000 accounting liability.

QSPP: Paying Benefits Before the Disability Occurred

This also considers the company had an internal written agreement to make these benefit payments BEFORE the disability occurred, otherwise known as a Qualified Sick Pay Plan (QSPP). In the event a QSPP was not present prior to the disabling event, those benefit payments would additionally be considered Ad Hoc payments, which is NOT a good term for employers. If the payments were determined to be Ad Hoc, the employer would be removed of their ability to tax deduct those benefit payments as “employee compensation” and therefore face severe tax payments and penalties to the Internal Revenue Service. That $5,800,000 just became a much larger issue.

Getting back to FASB 112, the company would be required to hold the $5,800,000 liability on their balance sheet, decreasing each year by $580,000 (as the benefit payments are realized), and finally being completely withdrawn from the balance sheet once the CEO has returned to work full time, or until benefit payments cease (whichever occurs first). This is the case for one executive facing a disability. Can you imagine if two highly compensated employees were simultaneously facing an illness or injury?

What's the issue with a balance sheet liability?

At a time where a key executive is not actively at work, the business will likely suffer lost revenue/productivity. That’s not an ideal time to hold a new 7-figure liability on a business balance sheet.

If there are additional equity shareholders in the business, it will greatly impact their net earnings for each following year.

If the CEO determines they’d like to sell the business due to their disablement (this is a common occurrence), the company’s valuation will be fractional at best.

How can an employer avoid repercussions of FASB112?

Refuse to remit disability benefit payments to any individual beyond their provided disability insurance benefits. In this case above, let the CEO deal with their illness while earning 17% of their normal income. (P.S. This doesn’t end well).

Have a Qualified Sick Pay Plan that limits the amount of time benefit payments are guaranteed. If a company is profitable enough to support large disability payments, they can at least reduce the number of years those payments will need to be accounted for. (Not ideal for a positive company culture or executive recruitment & retention, but protects the company at the end of the day).

Transfer Liability with Disability Insurance

Transfer the liability to an insurance company. By implementing a supplemental disability insurance plan, the employer is no longer responsible for making disability benefit payments, or accounting for them on their balance sheet.

FASB 112 is rarely discussed until an employer is in the middle of an employee disability. The outcome isn’t a desirable one, which is why this article was produced. If you’d like to understand more about FASB 112, you can find more information on the Financial Accounting Standards Board’s website here.

If you rather not become a disability accounting expert, then I suggest finding a competent advisor to help you. Chances are high that I know of one in your area, please don’t hesitate to reach out.

by

Robert Clark, GBDS, DIF, LACP, LTCP

Disability Income Specialist — Broker & Advisor Resource

Originally published on LinkedIn. Used by permission.

If you have any questions or want to learn more,

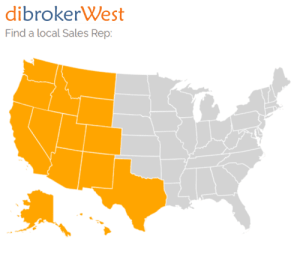

please give your Local Sales Rep a call!